Received: November 2024

DOI 10.17677/fn20714807.2024.06.02

Fluorine Notes, 2024, 157, 3-4

RETROSPECTIVE ANALYSIS AND FORECAST OF SOME FLUOROCHEMICALS INDUSTRIAL SECTORS DEVELOPMENT

V.V. Kornilov

Abstract: The production of fluorinated compounds is predicted to grow at a compound annual growth rate (CAGR) of 3 to 4.4% in the coming years. Growth is forecast in all major segments (fluorocarbons, fluoropolymers, inorganic fluorides, other fluorinated compounds, including precursors for medicine, production of semiconductors, dielectrics, etc.). Due to the depletion of natural fluorspar reserves, it is predicted that technologies will be developed and production facilities will be set up to produce hydrogen fluoride from phosphate fertilizer production waste.

Key words: hydrogen fluoride, fluorine, fluorspar, aluminum trifluoride, fluorosilicic acid, lithium hexafluorophosphate, fluoromonomers, fluoropolymers, fluoroelastomers.

At present, the directions related to fluorine chemistry are influenced by various factors, which, in particular, include:

- Depletion of fluorspar reserves in Europe and the USA, while fluorspar is the basic mineral raw material for the production of anhydrous hydrogen fluoride (AHF). This situation leads to dependence on fluorspar imports in a number of economically developed countries.

- Increasing influence of environmental requirements on the economy at the international and national level, which leads in some cases to refusal from the use of large-tonnage production of fluorine-containing compounds, as well as to refusal from the use of fluorine-containing compounds in a number of consumption areas. A classic example is the substitution of fluorinated compounds (except in the medical metered-dose inhaler sector) with alternative propellants in aerosol packages.

Nevertheless, fluorine compounds are projected to remain a major growth industry in the coming years.

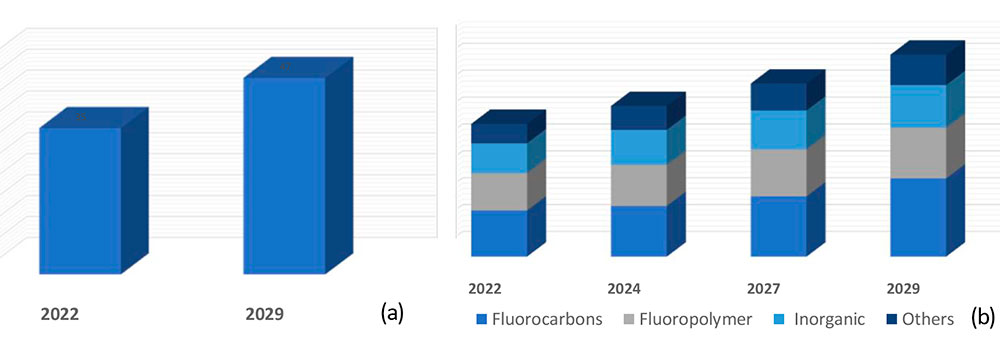

According to various forecasts, the Compound annual growth rate (CAGR) to 2029 will

be from 3 to 4.4% (Figure 1a).

Figure 1. Prediction of total growth (CAGR, Compound annual growth rate) (a) and growth of main segments (b) of fluorine-containing compounds in 2022 -2029

Moreover, growth is predicted in all main segments (Figure 1b), namely:

- fluorocarbons (this general category usually includes fluorocarbons (FCs) as well as fluorochlorocarbons

(CFCs), hydrofluoroolefins (HFOs) and hydrochlorofluorocarbons (HCFCs). The latter often act as a

precursor for the production of fluoropolymers.

- fluoropolymers.

- inorganic fluorides (primarily aluminium trifluoride).

- other fluorine-containing organic compounds (these include precursors for producing medical preparations,

oils and lubricants, dielectrics and a wide range of other applications).

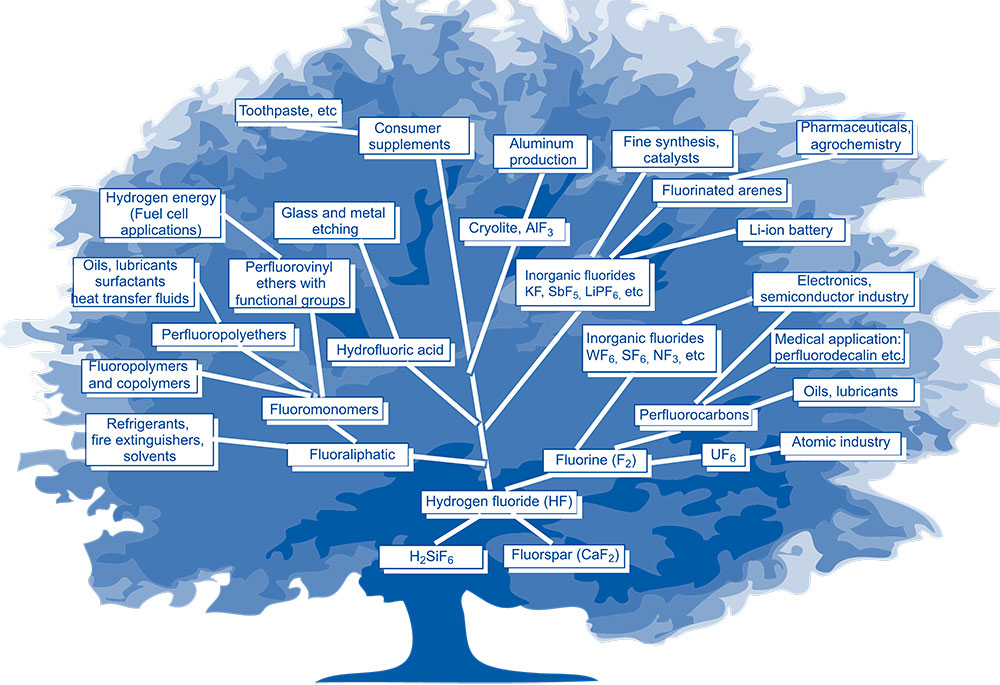

The main directions of production and use of fluorinated compounds in the form of an enlarged scheme are represented in Figure 2.

Figure 2. The main directions of production and use of fluorinated compounds.

1. Sources of raw materials for the anhydrous hydrogen fluoride production

As can be seen from Figure 2, the entire chemistry of fluorine compounds is based on Anhydrous Hydrogen Fluoride (AHF).

In industry, AHF is mainly produced by the interaction of calcium fluoride, which is found in natural fluorspar (NF, natural calcium difluoride, fluorspar), with sulphuric acid.

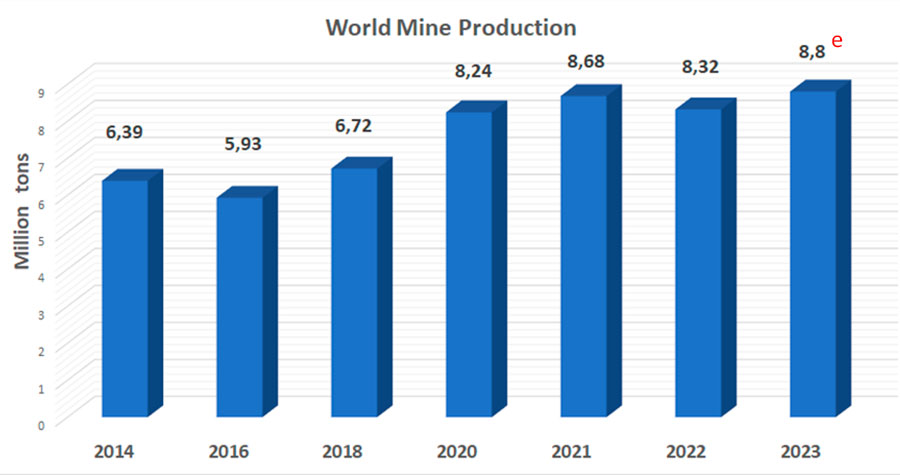

As of 2018, the world resources of fluorspar were estimated at approximately 500 million tons. In recent years, only proven reserves (so-called Reserves) of fluorspar have been published. Thus, the US Geology Service (USGA) report for 2024 shows a value of 280 million tons, with most of the reserves attributed to four countries: China, Mexico, Mongolia, South Africa (Table 1) [1].

Figure 3 represents the dynamics of fluorspar production, which shows a general trend of increasing fluorspar production over the last decade.

Figure 3. Dynamics of fluorspar production.

e -estimation indicators.

Table 1 shows the Country distribution of fluorspar production.

Table 1. Proven Reserves (Reserves) and production of fluorspar per country.

|

Mine production (thousand tons) |

|||

|

2022 |

2023 |

Reserves |

|

|

United States |

NA* |

NA* |

NA* |

|

China |

5700 |

5700 |

67000 |

|

Germany |

60 |

60 |

NA |

|

Iran |

116 |

120 |

4500 |

|

Mexico |

1000 |

1000 |

68000 |

|

Mongolia |

425 |

930 |

34000 |

|

Pakistan |

52 |

52 |

NA |

|

South Africa |

406 |

410 |

41000 |

|

Spain |

153 |

150 |

15000 |

|

Vietnam |

218 |

170 |

3400 |

|

Other countries |

190 |

170 |

50000 |

|

World total (rounded) |

8320 |

8800 |

280000 |

* NA – no data,

As can be seen from the presented data, proven reserves can be exhausted quite quickly at such mining rates.

Therefore, due to the risk of insufficient supply on the market and, consequently, possible consequences for the economy, fluorspar is classified in many countries as a strategically important mineral commodity.

For example, the U.S. Geological Survey's Mineral Commodity Summaries 2024 reports that the United States, Spain, Italy, Germany and Canada are preparing to reopen fluorspar mines that have been idle for decades [1].

In addition, the use of synthetic calcium fluoride, which can be obtained by neutralizing wastes from oil alkylation, stainless steel pickling or uranium conversion processes that use elemental fluorine or hydrogen fluoride, may become relevant. However, these directions are in some cases limited by the presence of undesirable impurities in such wastes.

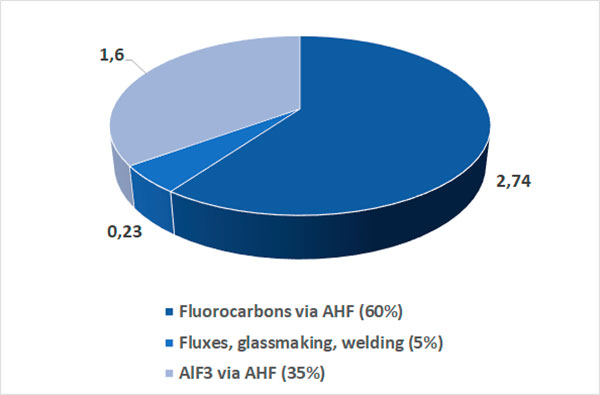

It should be noted that, for the production of AHF, not all the produced fluorspar can be used, but only the acid qualification fluorspar (so called acidspar) in which the content of calcium difluoride is not less than 97%. Figure 4 shows the estimated distribution of the consumption of acidspar on the main segments in 2019 [2].

Figure 4. Estimated distribution of acidspar consumption by main segments in 2019.

A potential source of hydrogen fluoride production could be the use of phosphate ores (phosphorites and apatites), which contain up to 3.5% fluorine, as raw materials. Their world reserves are estimated at 74 billion tons, which is equivalent to about 5 billion tons of 100% fluorspar [1].

In the process of producing phosphoric acid, which is then sent to obtain phosphorus fertilizers, the phosphate ore is treated with sulphuric acid to form silicon tetrafluoride (SiF4) and hydrogen fluoride as by-products. These gaseous compounds are usually absorbed by water to form a 18% solution of fluorosilicic acid (hereinafter FSA, H2SiF6).

So far, most of the FSA has been neutralized and sent to waste, and only a small portion has been used to fluorinating drinking water or producing aluminum trifluoride. It should be noted that aluminum trifluoride produced by this method cannot replace conventional aluminum trifluoride used in the primary aluminum production process due to impurities.

In the US, for example, in 2019, approximately 17000 tons of FSA (equivalent to ≈27000 tons of 100% fluorspar) were produced from four phosphoric acid plants that are used to fluoridate drinking water. This ratio has increased to 40000 tons of FSA (equivalent to ≈65000 tons of 100% fluorspar) in 2023 [1]. However, this is only a small fraction of the FSA produced.

The total estimated amount of by-product FSA, based on total phosphoric acid output, was at least 1.75 million tons for 2021, equivalent to about 1.34 million tons per AHF [3].

The Swiss company Buss ChemTech AG was the first to announce an industrial method of obtaining AHF from FSA, which in 2008 launched the first plant in Guizhou, China, with the Chinese fertilizer manufacturer Wengfu (Group) [4].

At the end of 2022, Buss ChemTech claimed to operate six plants in China to produce AHF from FSA, including following plants:

- 20 000 MT/year AHF –Machangping (2008)

- 12 000 MT/year AHF –Lantian (2012)

- 20 000 MT/year AHF –Hubei (2013)

- 30 000 MT/year AHF –Yunnan (2018)

- 30 000 MT/year AHF –Guizhou (2020)

In addition, one plant was in the commissioning phase and another plant was in the design phase.

Also in 2020, a project to establish a 40,000-tonne capacity production facility in the US (North Carolina) with the French company Arkema was initiated with the aim of being operational in 2022 (from the US Geological Survey's 2022 report). However, in the 2023 report, it was reported that this production facility was still under construction. And in 2024 there is no mention of this production [1].

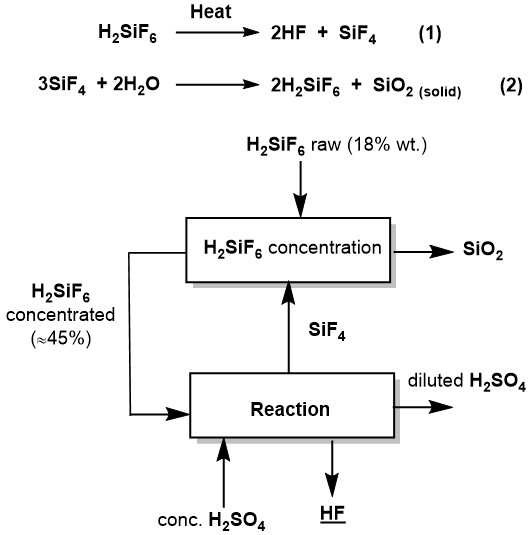

The process for producing AHF through a direct reaction of FSA with sulfuric acid is described in the paper of representatives of Buss ChemTech in the journal Procedia Engineering [4]. Figure 5 shows the basic equations and a simplified block diagram of the process.

Figure 5. Basic equations and simplified flowchart of the AHF production process via direct reaction of FSA with sulfuric acid.

At the first stage, a 18% solution of fluorosilicic acid (this is a standard concentration in phosphate fertilizer production technology) interacts with silicon tetrafluoride to obtain a concentrated 45% solution of fluorosilicic acid.

At the second stage, thermal decomposition of fluorosilicic acid takes place, and moreover the heat is obtained due to the reaction of concentrated sulfuric acid hydration.

Despite apparent simplicity, the process has difficulties. One of them is the separation of fine-dispersed SiO2. In addition, significant amounts of concentrated sulfuric acid are required for the process, which releases heat necessary for the reaction during the dehydration process.

Currently, there are other producers of AHF from FSA. Thus, Do-Fluoride New Materials (China) announced the launch of a plant with a capacity of 30,000 tons in 2023 [3].

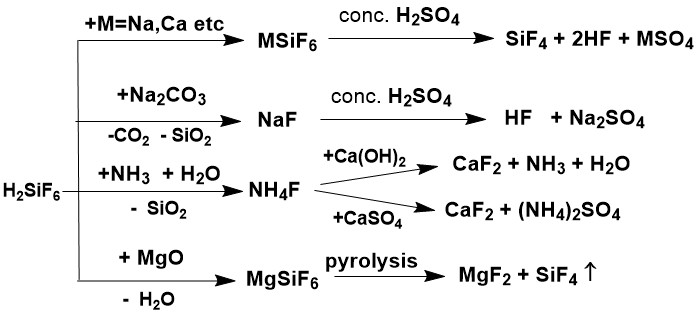

In addition to the direct reaction of interaction of FSA with concentrated sulfuric acid, several methods

were proposed to produce intermediate salts, which could then be converted into AHF [5]. Such salts

were Sodium Silico Fluoride, Na2SiF6, sodium bifluoride, sodium fluoride, ammonium

fluoride, magnesium fluoride, and others. Some of these methods are presented in Figure 6.

Figure 6. Preparation of intermediate salts from FSA.

Although the share of AHF from the alternative method is only a few percent (about 6% of the total AHF produced in China in 2022), it is assumed that the release of AHF from the FSA will increase since the reserves of fluorspar are limited.

2. Global Anhydrous Hydrogen Fluoride Market

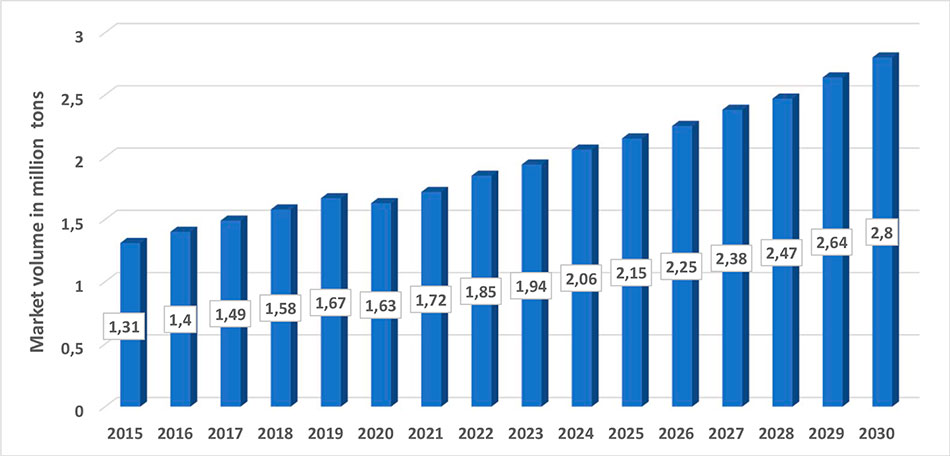

Figure 7 shows the retrospective data from 2015 for global AHF production and the prognosis for AHF production to 2030.

Figure 7. Retrospective data from 2015 for global AHF production and prognosis for AHF production to 2030.

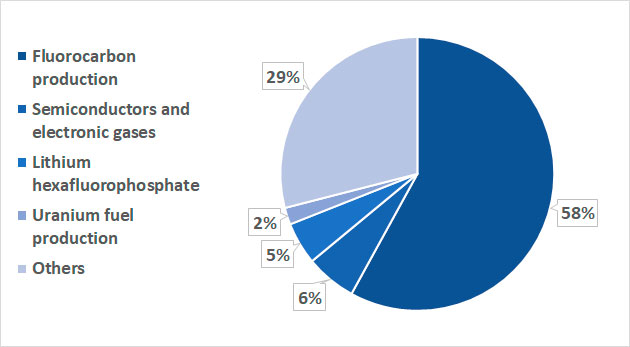

The dynamics of AHF prices in different regions of the planet (USD/kg) (Table 2) [7] and the distribution of AHF consumption by major segments (Figure 8) [6] are also presented.

Table 2. AHF price dynamics in different regions (USD/kg).

|

May 2018 |

Dec 2023 |

May 2024 |

|

|

USA |

1,46 |

2,5 |

2,49 |

|

China/North-East Asia |

1,35 |

1,53 |

1,61 |

|

Europe |

1,77 |

2,67 |

2,65 |

|

South-East Asia |

1,75 |

2,26 |

2,24 |

Figure 8. Distribution of AHF consumption in 2023 by major segments.

As can be seen from the diagram in Figure 8, the main part of anhydrous hydrogen fluoride is directed to the fluorocarbon production segment.

3. Inorganic fluorides

3.1. Aluminium trifluoride

The largest-capacity of inorganic fluorine compounds is aluminum trifluoride (AlF3), which is used as a flux in the production of primary aluminum at metallurgical plants. It takes 18 kg of aluminum trifluoride to produce 1 ton of aluminum. Moreover, only high bulk density AlF3 (HBD AlF3), which is obtained by interaction of anhydrous hydrogen fluoride with dry aluminum hydrate, is suitable for use in the metallurgical industry.

Figure 9 shows the dynamics of primary aluminum production from 2014 to 2023. [8].

Figure 9. Dynamics of primary aluminum production from 2014 to 2023. [8].

While in 2014 the demand for aluminum trifluoride was just over 1,000,000 tons, in 2023 it is already 1,270,000 tons accordingly.

Most forecasts estimate primary aluminum production growth from 3% to 5% annually over the next few years, with a corresponding increase in aluminum trifluoride demand.

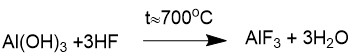

3.2 Potassium fluorides

The scale of potassium fluorides production is not as significant as aluminum fluoride (e.g., it was ≈30,000 tons in 2013 [9]).

However, the processes in which potassium fluorides are used also play a major role, so most forecasts predict a moderate growth of potassium fluoride consumption in the next years in the range of 2.8÷5.2%. The main directions of use:

1. Synthesis of fluoroorganic compounds through a halogen substitution reaction on fluorine (Halex fluorinating agent). It is used in the production of pesticides and in pharmaceutics. Due to environmental requirements to the use of chlorine-containing compounds, the value of this direction will decrease.

2. Production of elemental fluorine in laboratory and industrial scales by electrolysis of potassium bifluoride melt.

3. Melting special types of glasses which are resistant to the hydrofluoric acid exposure.

4. In metallurgy for removal of oxide films from surfaces of any metals that interfere with soldering (used as a flux).

5. One of the few substances which are suitable for soldering silver.

6. Other directions.

3.3. Lithium hexafluorophosphate (LiPF6)

Fluorine compounds used in electrolytes for Lithium-ion batteries (LIB) are projected to grow at a very high rate (up to 20% per year from 2023 to 2028). This trend is associated with the rapid growth of the technology sectors related to their application (transportation, backup power supplies, electronics manufacturing, etc.).

Among such electrolyte components, the greatest value currently has lithium hexafluorophosphate. According to the forecasts for 2028, a significant segment of the market will take LiFSI lithium (bis-fluorosulfonyl)imide and partially sodium hexafluorophosphate [6].

LiPF6 Lithium hexafluorophosphate

LiFSI Lithium bis(fluorosulfonyl)imide

LiFTSI Lithium bis(trifluoromethanesulfonyl)imide

LiODFB Lithium difluorooxalate borate

LiPO2F2 Lithium difluorophosphate

TMSP Tris(trimethylsilane)phosphate

NaPF6 Sodium Hexafluorophosphate

In China alone, the demand for LiPF6 is estimated at 250,000 tons by 2028 [6].

4. Elemental fluorine and its direction of use

It is considered that a few percent (2 ÷ 4%) of the produced AHF is used for the production of elemental fluorine. Nevertheless, compounds that are produced using direct fluorination processes or fluorine carriers play a very important role in modern life.

As of 2015, global fluorine production was estimated at 28,000 tons [9] excluding fluorine used to produce fuel for the nuclear industry.

The main uses of fluoride are:

1. Uranium enrichment.

2. Production of sulfur hexafluoride, nitrogen trifluoride and other inorganic fluorides (WF6, ReF6, halogen fluorides). From this direction the most significant in terms of both production volume and importance are:

а) sulfur hexafluoride, which has good dielectric properties. The main application is high-voltage electrical equipment (switches, transformers, etc.).

b) nitrogen trifluoride, which is used in the semiconductor industry and LCD panel production.

The production volume of both compounds is estimated in thousands of tons. For example, in 2013, the production volume of sulfur hexafluoride and nitrogen trifluoride was estimated at 10,000 tons of each compound [9].

Although both of these compounds have very high GWP (Global Warming Potential), most projections predict an increase in consumption of these products between now and 2030.

This appears to be due to the difficulty of replacing these compounds in a number of use directions with alternative low GWP compounds.

For example, heptafluoroisobutyronitrile proposed for replacing sulfur hexafluoride requires complex multistage synthesis. Furthermore, heptafluoroisobutyronitrile has higher toxicity as compared to sulfur hexafluoride.

3. Production of fluorocarbons by direct fluorination of hydrocarbons or through cobalt trifluoride. Such methods are used to obtain oils and lubricants necessary for nuclear industry, reagents for semiconductor industry (CF4, C2F6), as well as a number of cyclic fluorocarbons for use in medicine and biology (artificial blood, ophthalmology, etc.).

4. Partially pure elemental fluorine or in the form of mixtures of fluorine with nitrogen is used in the semiconductor industry as a reagent for plasma chemical melting.

5. Fluorocarbon

The general category of fluorocarbons generally includes fluorocarbons (FC) themselves as well as fluorochlorocarbons (CFC), hydrofluorocarbons (HFC), chlorofluorohydrocarbons (HCFC), and hydrofluoroolefins (HFO).

The total consumption of fluorocarbons is projected to have an average annual growth rate of 2.3% until 2028. Moreover, the consumption of hydrochlorofluorocarbons (HCFC), which are used as a raw material to produce fluoromonomers and further polymers, will grow at a higher rate of 3.2% [10].

For example, in 2023, about 53% of all fluorocarbons were used as precursors for the fluoropolymers production [6]. This is due to both the gradual withdrawal from the use of hydrofluorocarbons (HFCs) as refrigerants and foaming agents and the continuous growth of fluoropolymer production.

In 2017, the total production of these compounds was estimated to be 1.9 million tons [10], and in 2022 it will be about 2 million tons.

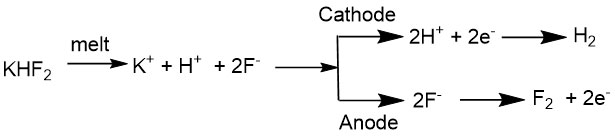

Figure 10 shows general applications of fluorocarbons and schematic diagrams for the production of basic fluorocarbon monomers and polymers.

Figure 10. General directions of fluorocarbons application and schematic diagrams of basic fluorocarbon monomers and polymers production.

Currently, HFCs and HFOs are primarily used as target products in the following areas:

- Cooling agents in Refrigeration & Air Conditioning. For example, R32 (difluoromethane) is still one of the main refrigerants in domestic air conditioners, and the number of cars in the world using HFO-1234 yf (2,3,3,3 - tetrafluoropropene) in air conditioners by the end of 2022 was approaching 200 million [11].

- Aerosol Propellants (primarily in the manufacture of medical dose inhalers).

- Foam Blowing Agents.

- Fire Protection.

HCFCs are used as precursors for producing basic fluorine-containing monomers and polymers.

The scheme shows the ways of obtaining basic fluorinated monomers and polymers. Thus, tetrafluoroethylene and hexafluoropropylene are obtained from difluorochloromethanane to produce fluoropolymers (TFE, PVDF) and fluorinated copolymers (FEP, ETFE, PFA, copolymers with perfluorosulfonylvinyl ethers). The latter are used as precursors for the preparation of ion exchange membranes for hydrogen power engineering and for electrolysis.

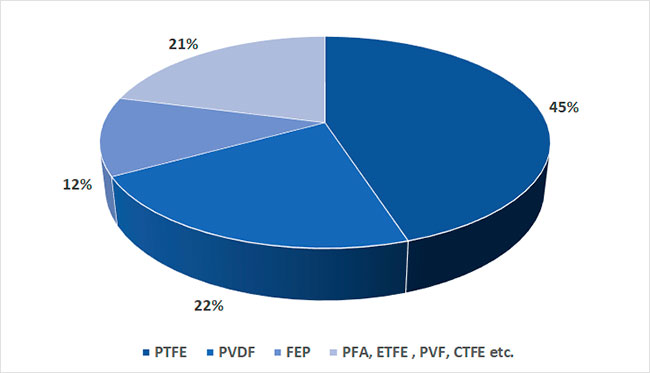

6. Fluorine-containing polymers and elastomers

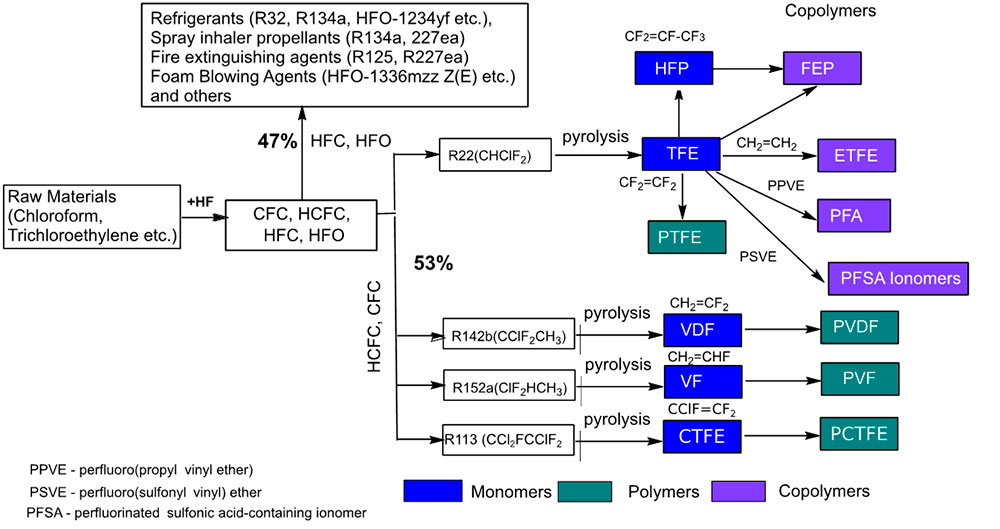

While in 2016 the total output of fluoropolymers was estimated at 273 thousand tons (of which 160 thousand tons of PTFE) [9], in 2022 the total output of fluoropolymers was already estimated at about 330 thousand tons with the potential to grow to ≈440 thousand tons by 2028.

Figure 11 shows the distribution of the main polymer types in November 2022 [12]. It can be noted that over the last decade there has been a gradual decrease in the share of PTFE in the total output of fluoropolymers.

Figure 11. Distribution by the main types of fluoropolymers output volume in 2022.

This is due to the fact that PVDF, FEP, PFA, ETFE unlike PTFE are melt-processable copolymers, which expands the possibilities of their use. For example, it becomes possible to produce films of such polymers by extrusion method or to produce polymer shells of electric cables from the melt. In addition, wastes of films, shells and other applications of fusible polymers can be subjected to multiple processing without change of basic properties.

The global fluorine-containing rubbers (another name for fluoroelastomers) market reached a value of 37 thousand tons in 2022 with a promising growth of about 3.5% per annum until 2032 [13].

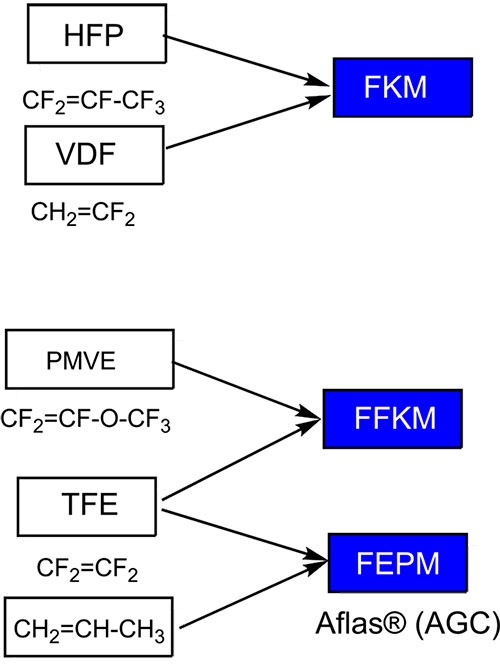

Three main classes of fluoroelastomers are highlighted:

- Fluorocarbon elastomers, which in the main chain of the polymer contain, except for fluorocarbon units, also fragments with hydrogen atoms. – FKM and FEPM

- Perfluorocarbon elastomers – in the main chain of the polymer only fluorocarbon units are contained (High Perfomance specialty) – FFKM

- Fluorosilicone elastomers – FVMQ

The types of the main fluoroelastomers are shown in Figure 12.

Figure 12. Types of the main fluoroelastomers.

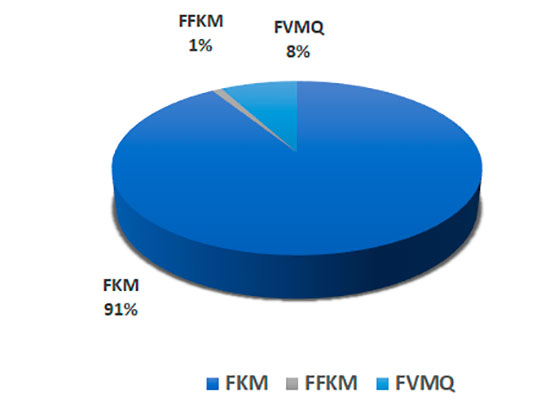

It should be noted that FKM fluoroelastomers have the major market share (more than 90%) (Figure 13) [10].

Figure 13. Market distribution of the main types of elastomers.

7. Fluorine in Pharmaceuticals

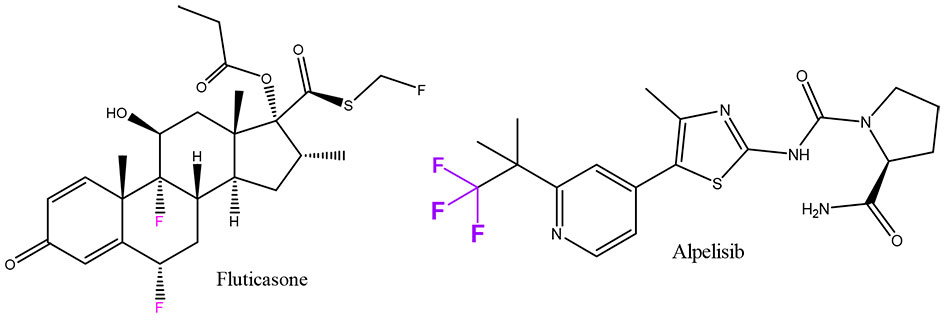

According to various estimates, at least 20% of modern medical drugs contain fluorine atoms in their composition [14], and this market will only develop.

Examples include Fluticasone, one of the most successful drugs for nasal congestion, and the anticancer drug Alpelisib, which was authorized for use only a few years ago.

There are several reasons why fluoride is often present in drug formulations [15], the main ones are as follows:

- First of all, F atom is slightly larger than the H atom, it does not significantly alter the parent structure when H is replaced by F in a drug candidate.

- Then, the C–F bond is the strongest link that carbon can make and it often boosts the metabolic stability of fluoro-pharmaceuticals.

- And, as the most electronegative element (3.98), F causes bond polarization, which can affect the lipophilicity/hydrophilicity balance of a compound.

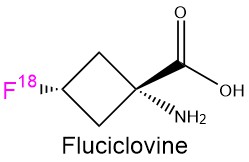

In addition, there is also a market for fluorine-18 isotope, which is one of the main radionuclides for Positron emission tomography (PET). This area is projected to grow at a compound annual growth rate (CAGR) of at least 4.5% through 2031. For example, fluciclovine is a radiopharmaceutical for prostate cancer diagnostics.

Syntheses of such compounds are very science-intensive processes and are based on fine organic synthesis.

There are several ways to introduce such fluorine fragments into complex organic molecules.

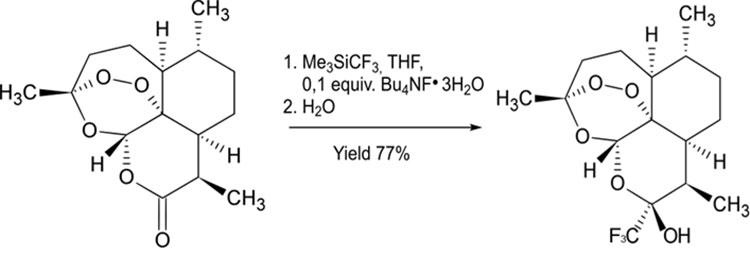

1) Use of trifluoromethyltrimethyl silane (TFMTMS, CF3Si(CH3)3,Ruppert–Prakash reagent) and its homologues, which allow the addition of a trifluoromethyl group to the point of the carbonyl group.

Thus, for example, an antimalarial preparation of Artemisinin derivative with a trifluoromethyl group has been obtained.

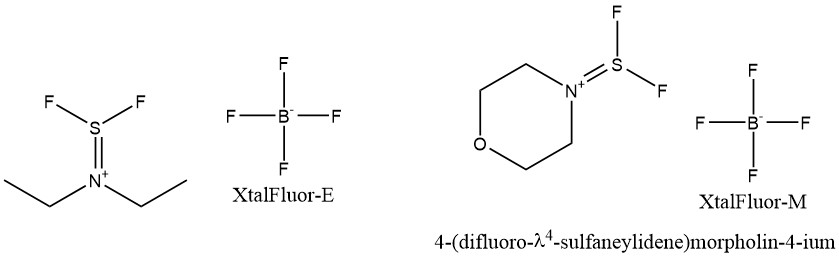

2) Application of various nucleophilic fluorinating reagents for Deoxofluorination reactions. Deoxofluorination of hydroxyl and carbonyl groups allows to introduce usually one or two fluorine atoms into complex organic molecules. The following reagents are used for this purpose (deoxofluorinating reagent):

- sulphur tetrafluoride,

- DAST (Dialkylaminosulfur Trifluorides, (C2H5) 2NSF3),

- Deoxo-Fluor (Bis(2-methoxyethyl)aminosulfur Trifluoride, (CH3O C2H4) 2NSF3),

- XtalFluor-E (Diethylaminodifluoro-sulphonium tetrafluoroborate) и XtalFluor-M (Morpholindifluoro-sulphonium tetrafluoroborate)

In the presented row of deoxo-fluorinating reagents, the dynamics of such compound’s chemistry development can be observed.

Sulfur tetrafluoride is very inconvenient to use especially in laboratory research because it is a toxic gas under normal conditions.

DAST is already a liquid, but is explosive at elevated temperatures.

Deoxo-Fluor has extended the temperature range of deoxofluorinating reagents and reduced the requirements for safe handling, in particular for storage and transportation.

XtalFluor is already a solid crystalline compound that can be safely stored under laboratory conditions in glass.

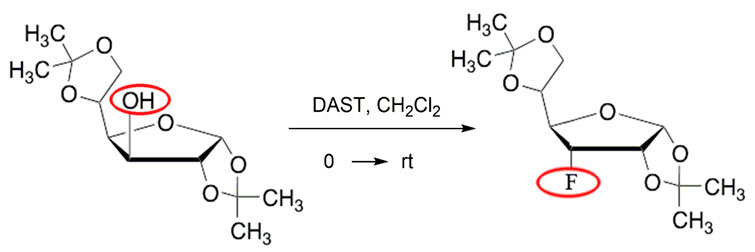

As an example, a hydroxyl substitution reaction for a fluorine atom in D-glucofuranose derivatives (1,2,5,6 - di-O-isopropylidene-a-D-glucofuranose) is carried out using DAST, in this case the substitution occurred with the inversion of the spatial position of the group [16].

In addition, there are other types of reagents:

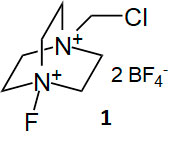

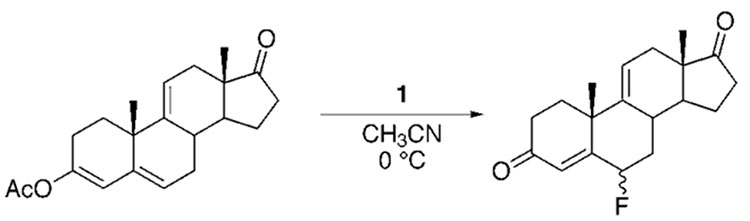

SelectFluor is an electrophilic reagent for introducing fluorine into complex molecules which is a crystalline substance which is stable at temperatures up to 195°C [17].

As an example, the slide shows the synthesis of a fluorinated glucocorticoid derivative, which refers to steroid hormones produced by adrenal cortex.

Glucocorticoid fluorination

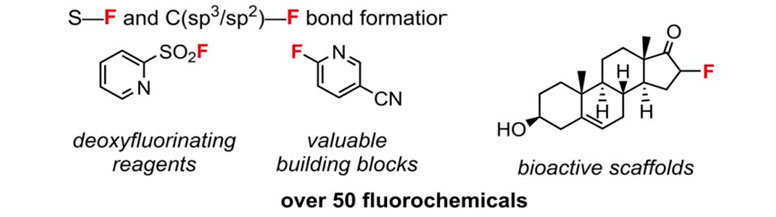

Finally, a new Fluoromix ® [18] fluorinating reagent can be mentioned. It was proposed by researchers from the University of Oxford. The peculiarity of this reagent is that it is obtained directly in a ball mill from acid-qualified fluorspar and potassium phosphate.

K3(HPO4)F + K2-xCay(PO3F)a(PO4)b

This fluorinating agent is reported to have more than fifty reactions in a solvent to produce fluorine-containing compounds.

The choice of a particular reagent depends on the assigned task.

It can be assumed that work in this direction of searching for new reagents for the introduction of fluorine into complex organic molecules will continue.

Conclusions

Summarizing all of the above, we can formulate several major important directions for the development of the chemistry of fluorine-containing compounds in the coming years:

- Development of technologies and creation of facilities for production of hydrogen fluoride from phosphate fertilizer production waste,

- Development of nomenclature and capacities for production of electrolyte components for lithium-ion batteries,

- Development of technologies for the production of third-generation substitutes for ozone-depleting compounds for selected directions (for example, SF6),

- Development of nomenclature and capacities for production of fusible fluoroplastics and fluororubbers,

- Research and development of new medical preparations containing fluorine atoms.

References

- U.S. Geological Survey, Mineral commodity summaries 2024, 2023, 2022, 2019 (Source: https://www.usgs.gov/centers/national-minerals-information-center/mineral-commodity-summaries).

- O. Rhode, Fluorspar Supply & Demand Overview, Report on Fluorine Forum 2020.

- Lingyun-Li, Fluorine Chemical Industry – New development trend in China, Report on Fluorine Forum 2023, October 2023, France.

- a) T. Dahlke, O. Ruffiner, R. Cant, Production of HF from H2SiF6, Procedia Engineering, 2016, V. 138, pp 231-239, DOI: https://doi.org/10.1016/j.proeng.2016.02.080 b) An update on the comparison between FSA and CaF2 raw material. Report Buss Chemtech AG on Fluorine Forum 2020; c) Fluorine Technologies. Diversification Opportunities, Report Buss Chemtech AG on Fluorine Forum 2022.

- Yang H., Li S., Yu H., Liu H., Sun K. and Chen X., Production of anhydrous hydrogen fluoride from fluorosilicic acid: a review, Front. Chem., 2024, 12:1372981; doi: 10.3389/fchem.2024.1372981;

- S. Wietlisbach, Fluorine: Fundamental element on the path to net zero, Report on Fluorine Forum 2023, October 2023, France.

- Hydrofluoric Acid/ Hydrogen Fluoride price index (Source: https://businessanalytiq.com/procurementanalytics/index/hydrofluoric-acid-price-index/)

- International Aluminium Institute (https://international-aluminium.org/statistics/primary-aluminium-production/).

- Alain Dreveton, Overview of the fluorochemicals industrial sectors, Procedia Engineering, V. 138, 2016, pp. 240-247, DOI: 10.1016/j.proeng.2016.02.081.

- a) S&P Global, Fluorocarbons, Chemical Economics Handbook (Source: https://www.spglobal.com/commodityinsights/en/ci/products/fluorocarbons-chemical-economics-handbook.html); b) S. Wietlisbach, Fluorochemicals Outlook, Report on Fluorine Forum 2020 (https://imformed.com/wp-content/uploads/2020/10/WIETLISBACH-Fluorine-Forum-2020-ONLINE.pdf)

- Global Number of Vehicles Using HFO-1234yf Refrigerant (Source: http://www.igsd.org/wp-content/uploads/2021/12/Global-Number-of-Vehicles-Using-HFO-1234yf.pdf.

- S&P Global, Fluoropolymers. Chemical Economics Handbook (Source: https://www.spglobal.com/commodityinsights/en/ci/products/fluoropolymers-chemical-economics-handbook.html)

- Fluoroelastomer market analisys. ChemAnalyst. (Source: https://www.chemanalyst.com/industry-report/fluoroelastomer-market-684).

- Munenori Inoue, Yuji Sumii, and Norio Shibata, Contribution of Organofluorine Compounds to Pharmaceuticals, ACS Omega 2020, 5 (19), 10633-10640, DOI: 10.1021/acsomega.0c00830

- Henary, E.; Casa, S.; Dost, T.L.; Sloop, J.C.; Henary, M. The Role of Small Molecules Containing Fluorine Atoms in Medicine and Imaging Applications. Pharmaceuticals 2024, 17, 281. https://doi.org/10.3390/ph17030281

- Timothy J. Tewson and Michael J. Welch, New approaches to the synthesis of 3-deoxy-3-fluoro-D-glucose, The Journal of Organic Chemistry 1978, 43 (6), 1090-1092, DOI: 10.1021/jo00400a014

- P. Nyffeler, S. Durón, M. Burkart, S. Vincent, Chi-Huey Wong, Selectfluor: Mechanistic Insight and Applications, Angewandte Chemie International Edition, 2005, V. 44, Iss. 2, pp. 192-212, DOI: 10.1002/anie.200400648.

- Calum Patel et al., Fluorochemicals from fluorspar via a phosphate-enabled mechanochemical process that bypasses HF, Science, 381, pp. 302-306 (2023), DOI:10.1126/science.adi1557

ARTICLE INFO

Received 18 November 2024

Accepted 4 December 2024

Available online December 2024

Recommended for publication by PhD O.V. Bryzgalova

eLIBRARY Document Number (EDN) WOPVEW

Fluorine Notes, 2024, 157, 3-4